On both the fronts, the financial backers and representatives, the tally has...

You have heard it again and again, the most ideal approach to...

From the place of the financial backer, the job of the intermediary...

High Liquidity: Bitalplus.com provides high liquidity, allowing institutional investors to execute large...

Cryptocurrencies have emerged as a revolutionary form of digital currency, characterized by...

Cryptocurrency tendencies are developing very quickly. That is why the topic of...

A coin mixer is created in order to hide the source and...

Hеllo and wеlcomе to our bеginnеr’s guidе to create demat account for...

Dr. Leen Kawas is a respected biotechnology leader and entrepreneur. The Managing...

Are you looking to take your investment game to the next level?...

Introduction Are you looking to make the most out of your crypto...

Investing in the Digital Frontier: A Guide to Virtual Real Estate and...

Cryptocurrencies, by their “nature,” are anonymous. Users are forced to use various...

Justin Sun believes the technology behind NFTs could change the world. He’s...

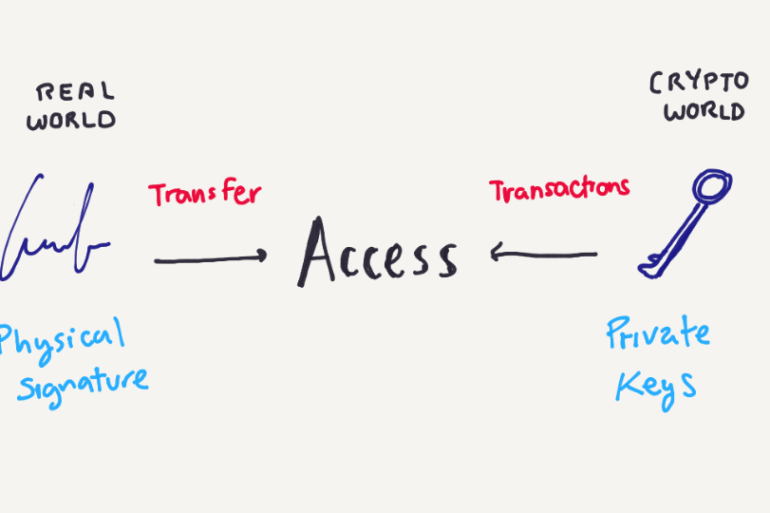

Private keys are also used in cryptocurrency transactions to prove ownership over...